Pacific Prime Things To Know Before You Buy

Pacific Prime Things To Know Before You Buy

Blog Article

Getting My Pacific Prime To Work

Table of ContentsPacific Prime for BeginnersPacific Prime Fundamentals ExplainedThe Best Strategy To Use For Pacific PrimeThe Ultimate Guide To Pacific PrimeRumored Buzz on Pacific Prime

Your representative is an insurance policy professional with the understanding to direct you via the insurance process and assist you find the ideal insurance coverage defense for you and individuals and points you care about many. This article is for informative and tip functions just. If the policy insurance coverage summaries in this write-up conflict with the language in the policy, the language in the policy applies.

Insurance holder's deaths can likewise be contingencies, especially when they are considered to be a wrongful fatality, as well as property damage and/or devastation. Because of the unpredictability of said losses, they are classified as contingencies. The insured person or life pays a premium in order to obtain the advantages assured by the insurance provider.

Your home insurance policy can help you cover the problems to your home and pay for the cost of rebuilding or repair work. In some cases, you can also have protection for items or valuables in your residence, which you can after that acquire replacements for with the cash the insurance provider provides you. In case of a regrettable or wrongful death of a sole income earner, a family's financial loss can possibly be covered by specific insurance coverage strategies.

The Facts About Pacific Prime Revealed

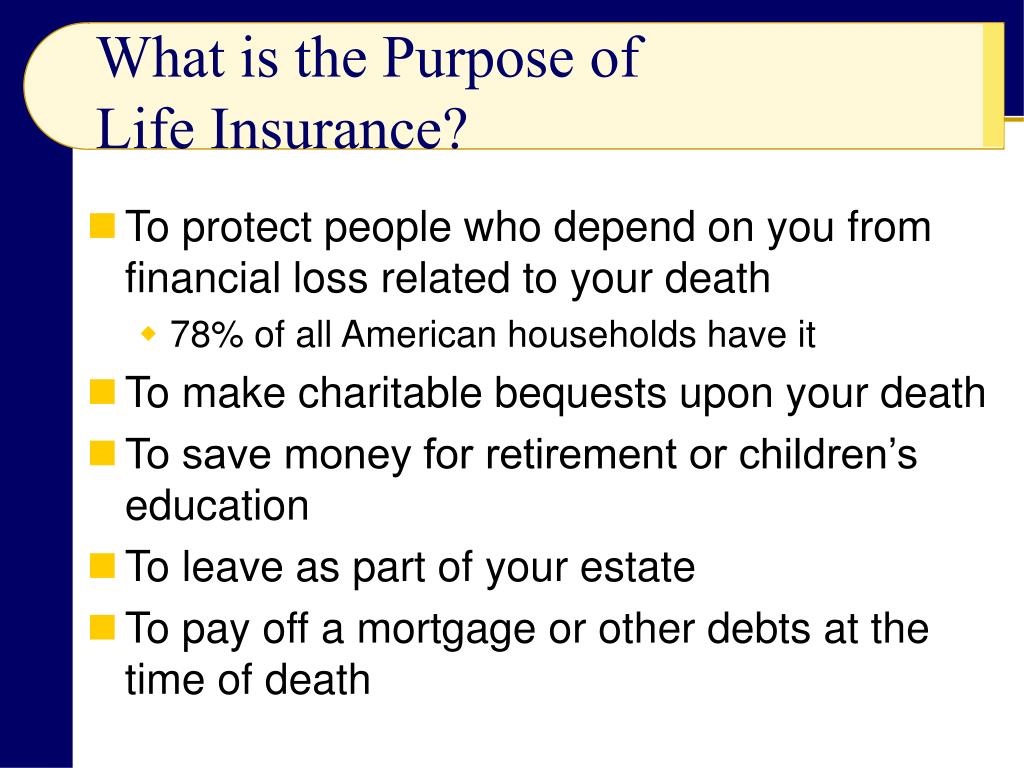

There are numerous insurance intends that include cost savings and/or financial investment systems along with routine protection. These can assist with building financial savings and wealth for future generations through routine or reoccuring investments. Insurance coverage can help your family members keep their requirement of living in the event that you are not there in the future.

One of the most standard type for this kind of insurance policy, life insurance, is term insurance coverage. Life insurance coverage generally helps your family members become protected economically with a payment amount that is provided in the event of your, or the policy owner's, death throughout a particular policy period. Child Plans This kind of insurance policy is basically a savings instrument that assists with generating funds when kids reach particular ages for pursuing greater education.

Home Insurance policy This kind of insurance coverage covers home problems in the events of mishaps, all-natural tragedies, and problems, along with various other comparable occasions. international health insurance. If you are aiming to seek compensation for crashes that have taken place and you are struggling to identify the correct course for you, connect to us at Duffy & Duffy Law Office

The 20-Second Trick For Pacific Prime

At our law office, we comprehend that you are undergoing a great deal, and we comprehend that if you are coming to us that you have actually been with a whole lot. https://www.quora.com/profile/Freddy-Smith-136. Due to the fact that of that, we provide you a complimentary appointment to discuss your problems and see just how we can best assist you

Since of the COVID pandemic, court systems have actually been shut, which adversely affects car crash instances in an incredible means. Once more, we are below to help you! We proudly serve the people of Suffolk Region and Nassau Region.

An insurance plan is a lawful agreement in between the insurance provider (the insurance company) and the individual(s), organization, or entity being guaranteed (the insured). Reviewing your plan assists you confirm that the policy satisfies your demands which you recognize your and the insurer's duties if a loss takes place. Many insureds purchase a plan without recognizing what is covered, the exemptions that eliminate insurance coverage, and the problems that need to be satisfied in order for insurance coverage to apply when a loss occurs.

It identifies who is the insured, what threats or property are covered, the policy limitations, and the policy period (i.e. time the plan is in pressure). The Statements Web page of a life insurance coverage plan will include the name of the person insured and the face quantity of the life insurance coverage plan (e.g.

This is a summary of the major assurances of the insurance business and specifies what is covered.

See This Report on Pacific Prime

Life insurance plans are usually all-risk plans. https://trello.com/w/pacificpr1me_. The three major kinds of Exemptions are: Omitted hazards or reasons of lossExcluded lossesExcluded propertyTypical instances of excluded hazards under a property owners plan are.

Report this page